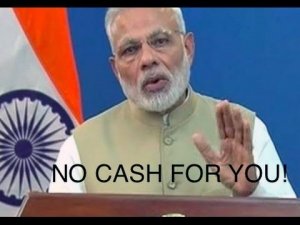

When money dies, what happens to the economy?

India’s Government Makes Banknotes Worthless by Decree Overnight. A so called demonetization. On the 8th of November 2016, India’s government banned the use of Rs 500 (~$7.50) and Rs 1,000 ($15) banknotes. This pretty much made most currency-in-use illegal. The two notes make up about 86% of the currency in circulation by value in India and represent the maximum—and most popular—currency denominations.

Banks and ATMs were closed the next day. The government believes that doing this will help eradicate corruption and push counterfeit money out of circulation. According to the Indian government, the counterfeit money tends to come from Pakistan and helps finance terrorism.

Banks and ATMs were closed the next day. The government believes that doing this will help eradicate corruption and push counterfeit money out of circulation. According to the Indian government, the counterfeit money tends to come from Pakistan and helps finance terrorism.

Demonetization causes damage to society

Now, a few weeks later, the situation is getting much worse, and more desperate by the day. It is obvious that Modi single-handedly took the decision to ban the banknotes, with most people in his cabinet and virtually all in the central bank oblivious to his plan.

There is virtually no visible opposition to the enforced ban, for any politician who opposes the ban risks having his own misdeeds — and they are all corrupt — brought to the public space by Modi. A true demagogue, Modi, has already convinced the gullible, salaried middle class that anyone who opposes the ban is hiding corrupt money and is anti-national.

With every passing day, it has not only become clearer that the ban was of no use to eradicate hidden cash. It has also inflicted deep, wide and irreparable damage to the society. The economy is rapidly moving toward stagnation. The lives of literally hundreds of millions are in deep chaos. It is estimated that 95% of transactions in India are made using cash, and for those squirreling money away, it is a necessity to survive.

Demonetization to fight black money

India has a large amount of what is known as “black money”. Meaning cash or any other form of wealth that has evaded taxation. According to different studies, this shadow economy makes up between one-fifth and one-quarter of the country’s G.D.P.

Black money tends to exacerbate inequality because the biggest evasions occur at the top of the income spectrum. It also deprives the government of money to spend on infrastructure and public services like health care and education. The government’s wish to tackle these problems is laudable. But demonetization is a ham-fisted move that will put only a temporary dent in corruption, if even that, and is likely to rock the entire economy.

Black money tends to exacerbate inequality because the biggest evasions occur at the top of the income spectrum. It also deprives the government of money to spend on infrastructure and public services like health care and education. The government’s wish to tackle these problems is laudable. But demonetization is a ham-fisted move that will put only a temporary dent in corruption, if even that, and is likely to rock the entire economy.

The demonetization program has far reaching consequences for the diamond and jewelry trade

India’s shock decision to abolish its higher-denomination currency notes will curb jewelry sales and diamond trading next year. Industry pundits have forecast the unorganized jewelry sector will bear the brunt of a sharp drop in demand as cash – the lifeline of smaller players – has already become a scarce commodity.

Large segments of the Indian economy, and indeed its diamond and jewelry trade, rely on cash to navigate the country’s infamous bureaucracy and corruption. Cash has also built up substantially from tax evasion with the bulk of that unaccounted for money sitting in higher denomination notes.

Large segments of the Indian economy, and indeed its diamond and jewelry trade, rely on cash to navigate the country’s infamous bureaucracy and corruption. Cash has also built up substantially from tax evasion with the bulk of that unaccounted for money sitting in higher denomination notes.

But this cash served an important purpose as it was channeled into various sectors of the economy, lifting aggregate demand across the country. Real estate was probably the biggest beneficiary, while the jewelry industry was not too far behind.

Following the announcement, jewelers experienced an initial rush into gold. But the spike in demand didn’t last long as jewelry sales plummeted 60 percent when the notes were no longer accepted as legal tender.

The unorganized segment will be hit particularly hard given their large proportion of unaccounted inventory and high proportion of cash sales, analysts at India Ratings wrote. “[We] expect demand for gems and jewelry to decline in the next two to three quarters,” the agency stressed.

Drop in interest rates

A surprise outcome of the demonetization move was a drop in interest rates. According to the State Bank of India, it reduced interest rates on deposits of more than one year. SBI Chairman Arundhati Bhattacharya expects that “all rates will fall” because of the large inflow of cash and the slowdown in demand for credit. The impact of cheaper lending for the diamond center in Mumbai is that diamond traders may find it easier to purchase rough. The question is will they do so, considering the drop in demand.

A “distinctly different” INR 500 note and a new INR 2,000 note are being introduced, but measures are also in place to slow their introduction and limit the amount of cash being used.

Business activity has practically frozen since the ban came into effect, as consumers scramble to deposit vast cash savings into their bank accounts and withdraw the limited amount of new notes available.

Liquidity is tight as those higher value notes reportedly accounted for about 85 percent of money in circulation. Furthermore, there are generally limitations set on credit card purchases and high fees attached. It will be some time before the circulation of a large volume of new denomination notes are embedded into the system and for the unorganized players to get their houses in order.

Drop in diamond trading

Therefore a drop in diamond trading is expected as those smaller jewelers will pull back from buying diamonds and gold due to their lack of liquidity. That will affect the smaller-sized polished suppliers who are the ones selling polished to the unorganized local jewelry market, often in INR 500 and INR 1,000 notes. The larger companies are generally focused on exports and deal in dollars, implying they are somewhat shielded from the current chaos.

Still, the liquidity freeze could influence a global slowdown in demand for lower color and clarity polished and in very small melee stones. India is, after all, the third largest consumer market for diamond jewelry, with those goods typical in the market.

There may be a knock-on effect in the rough market, again impacting smaller manufacturers and rough dealers.

Already, the move was felt at the De Beers November sight. Sightholders noted trading and premiums on the secondary market initially firmed during sight week but they later softened as Indian dealers pulled back after the demonetization announcement. This was especially noticeable in smaller goods, which are bought and sold with cash, wrote Dudu Harari, of diamond broker Bluedax, in his sight report.

Only time will tell if the demonetization program will leave an indelible mark on the rough market. Strong jewelry sales during the U.S. Christmas and Chinese New Year seasons will likely mitigate the impact of a subdued Indian market.

But diamantaires will note the continued trend restricting cash in the market. They’ve seen different steps taken before this by other governments, the banking sector and even industry players, largely to crackdown on money laundering. This column will outline those efforts and their impact in the coming weeks.

For now, it’s worth noting India’s attempt to legitimize its economy is necessary and admirable. But it will almost certainly negatively impact diamond and jewelry sales next year, if not beyond, as cash has emerged as the greatest luxury of all.

Sylvain Goldberg – on the sudden demonetization in India