LVMH, the world’s luxury titan, announced strong results over the full year. The sale of LVMH watches and jewelry grew by a double-digit percentage.

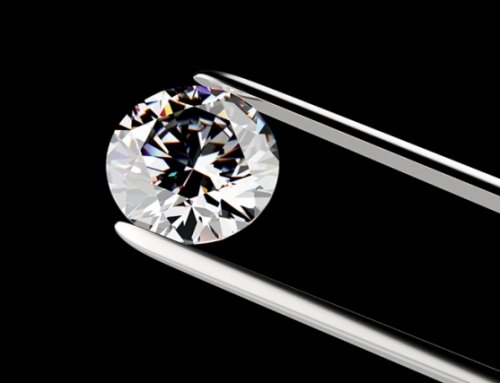

The sale of LVMH’s watch and jewelry brands totaled 4.12 billion EUR (4.73 billion USD) in 2018 compared with 3.80 billion EUR (4.36 billion USD) in 2017.

Organic revenue growth (on a comparable basis) was 12%.

Bvlgari got the crush of the year with particularly good results for relatively new creations such as the Octo Finissimo watch and the Fiorever jewelry collection.

Among LVMH watches brands, TAG Heuer smart watches have had a good start, while Hublot has seen solid growth and increased visibility as the official timekeeper of the FIFA World Cup in the summer. 2018.

With its Paris headquarters, LVMH Moёt Hennessy Louis Vuitton is to luxury products what Procter & Gamble is to consumer products, with brands of jewelry, watches, wines and spirits, leather goods, perfumes and cosmetics.

Total fourth-quarter revenue for the company reached 13.70 billion EUR (15.70 billion USD), compared to 12.54 billion EUR (14.40 billion USD) a year ago, continuing the upward trend of the quarters precedents.

Full-year revenues were EUR 46.80 billion (USD 53.70 billion), up 10% year-on-year, from EUR 42.60 billion (USD 48.91 billion) in 2017. The operating income rose 21% to 10 billion EUR (11.48 billion USD).

LVMH has dealt well with the “Chinese slowdown“. Sales in Asia grew by 15% organically. At the same time, sales in the United States rose 8%, while sales in Europe were up 7%.”The attractiveness of our brands, the innovation and quality of our products, the unique experience offered to our customers, as well as the talent and commitment of our teams are the strengths of the group and have once again the difference,” said CEO Bernard Arnault.

LVMH’s fashion and leather goods revenues totaled 18.45 billion EUR (21.18 billion USD), an increase of 15% in organic revenues compared to 15.47 billion EUR (17.76 billion USD) of a year ago, backed by Louis Vuitton’s iconic leather goods, as well as by its shoe lines.

The perfume and cosmetics segment reported organic revenue growth of 14% to 6.09 billion EUR (6.99 billion USD) against 5.56 billion EUR (6.38 billion USD) a year ago.

LVMH’s spirits segment reported organic revenue growth of 5% to EUR 5.14 billion (USD 5.90 billion) compared to EUR 5.08 billion (USD 5.83 billion) a year ago, benefiting from good momentum in China and growth in the United States and Europe.

The selective distribution segment saw organic revenue growth of 6% to 13.64 billion EUR (15.66 billion USD) against 13.31 billion EUR (15.28 billion USD) a year ago.

Sephora had another year of growth, with online sales increasing, particularly in North America and Asia. Nearly 100 new Sephora stores have opened around the world, including one in Shanghai and the first Sephora brand stores in Russia.

DFS, LVMH’s luxury duty-free shopping chain, regained profitability after closing its airport concessions in Hong Kong at the end of 2017. New sites have opened in Cambodia and Italy.

LVMH’s retail network comprises 70 brands and 4,950 stores worldwide.

The company said that, despite latent uncertainties in the retail environment, it maintained “cautious confidence” for the coming year.