Millennial consumers can be divided up into three main segments…

Luxury, and jewelry in particular, is a curious industry. On the one hand, it provides aspirational products and exclusive experiences to consumers; on the other hand, many brands treat consumers very literally: merely as a source of consumption.

While there are many examples of luxury brands turning razor-sharp consumer insights into products that not only resonate with, but actually move consumers, a staggering number of brands still implement a purely product-centric business model. This practice is especially prevalent in the jewelry industry: develop a product efficiently, then try to find a marketing angle.

With consumers more marketing savvy than ever, this business thinking is doomed. Millennials particularly are masters of distinguishing between product substance and marketing veneer.

Marketing skeptics

Consumers, especially millennials, want products that don’t just tell a marketing story, but are an expression of their story. They seek products that touch and move them, and that express who they are and strive to be. This is particularly true for jewelry — products no consumer needs but many want.

The first step to achieving this is to understand that there is no such thing as “the consumer” and that the current practice of dividing potential customers by age, gender, household income or family status cannot tell you anything about what moves them and why they buy.

Platinum Guild International has worked closely with the Sinus Institute — a global leader in consumer segmentation, sought for advice by companies and governments alike — to produce the largest consumer-segmentation study ever conducted for jewelry.

The research represents 180 million jewelry buyers across four markets (China, India, Japan and the US), constituting a total buying potential of $611 billion. It was designed to identify commonalities among jewelry buyers in order to group them into consumer segments according to their lifestyles, attitudes and the role jewelry plays for them.

Generation why

The study was able to identify six distinct segments, or “jewelry tribes” in each market. Another of key finding of the study is that although consumers span four markets without common culture, language, history or economic environment, they often share remarkable similarities in their attitudes and needs regarding jewelry.

Three tribes are particularly, yet not surprisingly, dominant among millennial consumers:

- status-seekers

- avant-gardists

- meaning-seekers

● Status-seekers

Status-seekers are looking for ways to signal their social status. To them, jewelry is not only a nice piece of adornment, it is a badge worn proudly. Simply labeling this demographic as show-offs would be an all-too-easy dismissal of what is important to them. They are merely seeking recognition from their peers, turbo-charged through social media, where experiences are judged by how many likes users collect and products are a means to win a global competition of sharing Instagram-worthy moments.

In the US alone, the pioneer market of digital innovations, status-seekers make up 24% of jewelry buyers, and their average age of 31 makes them a prime target for jewelers aiming to engage millennial consumers. They are also especially prone to platinum as the metal’s rarity is a genuine mark of distinction.

● Avant-gardists

Avant-gardists share the same need for recognition from their peers, but they do so for different reasons. Their primary need is to be valued for their qualities as innovators and early adopters of the latest trend. Think Williamsburg hipster with a taste for jewelry. Again, social media is a key driver behind the need for affirmation. To them, nothing beats being the first to discover and be part of a trend. Jewelry is a key component of the persona they are trying to create. While they do not buy for social status, they certainly have the means to do so. They have a higher income and would like to spend it on jewelry. In the US, more than half of them are willing to spend more than $5,000 on jewelry and their preference for platinum over gold makes them a key consumer segment for PGI.

● Meaning-seekers

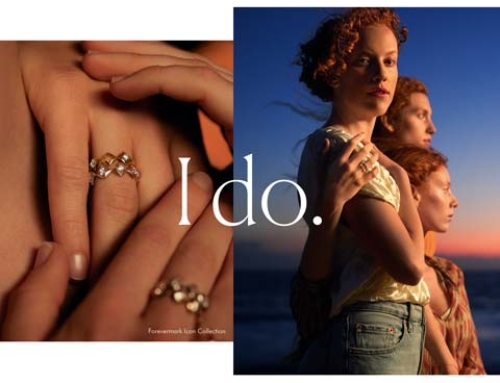

Meaning-seekers are in many ways the polar opposite of their recognition-seeking peers. They buy pieces of jewelry largely to mark the important milestones in their lives, not just their wedding day. Again, the search for meaning is well in line with common research findings about millennials: While digital platforms such as Tinder have made it infinitely easier to find your “other half” they have also facilitated moving on to the next potential soul-mate. The combination of opportunity and sky-high expectations for love has created an even stronger craving for deep, meaningful moments and relationships. To this group, jewelry is the perfect vehicle to mark those rare milestone moments. If they buy, they don’t buy small. They prefer opulent designs more than any other tribe, and have a particular preference for necklaces and earrings. They are particularly drawn to platinum for its status as the metal of love and its properties as an eternal keeper of moments that matter.

How do you address these three global tribes of jewelry?

Sylvain Goldberg