Recently, US President Donald Trump has raised the tax on commodities like steel and aluminium from China, to which Beijing responded with a 25% tax on several US commodities. Now, seniors in India’s diamond trade are worried that an escalation in the US-China trade war will be a major concern for India’s diamond trade, Art of Jewellery reports.

The US is a major buyer of gems and jewelry from India and China. The current duty on gems and jewelry stands at 6% on imports and has not been altered. However, if Trump decides to increase the duty on items such as gems and jewelry “to check shipments from China, it will hurt India as well”, according to the report.

Praveen Shankar Pandya, a former chairman of the Gem & Jewellery Export Promotion Council (GJEPC), was quoted in the report as saying: “Though the US has not done anything with the gems and jewelry sector as of now, the escalation of trade war between the US and China has generated a bit of nervousness in all sectors including gems and jewelry”. He added that what was more disturbing to the sector was bank finance: “If finance is curtailed, then the trade cannot grow. From April it is expected that banks will tighten finance to the sector and will ask for more collaterals. That will have an impact on the sector which is a major foreign exchange earner for the country. Exports in FY19 will be at par with FY18 with no growth if this situation continues”.

Other possible consequences of this trade war

Furthermore, if the trade war were to intensify there is a possibility that a diminished US-China trade engagement could have positive results for countries such as Brazil and India from a trade perspective, at least in the short run. In case of soybean, for instance, one of the key items in the list, there could be a cascading impact in terms of openings for India to enter other markets, according to the Soybean Processors Association of India.

The bulk of China’s annual soybean import of around 100 million tonnes is for domestic consumption; the rest is used in the manufacture of soybean oil and meal for export. If the levy hits China’s import, exports could be dented, a space that India could potentially fill to meet the demands from other countries.

But in the long term, a full-fledged trade war is bad news. It invariably leads to a higher inflationary and low growth scenario. Inflation is generally good for assets such as gold, while having a negative impact on currency and some sectors in the equity market.

China wants to treat other countries, especially major partners, well in case U.S. tariffs force Chinese exporters to depend more on markets outside the United States, analysts say. India is a prime target.

“It’s essentially having an insurance policy,” says Song Seng Wun, an economist with the CIMB private banking unit in Singapore. China is probably thinking, he says, that “we don’t know how things will pan out with the U.S., but in the meantime, China should see what’s best for ourselves.”

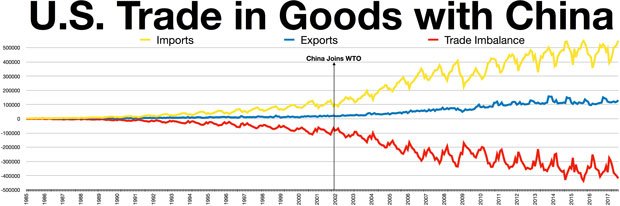

Beijing knows India finds the trade relationship uneven, experts say, increasing the urgency to please it. China would explore better relations in “new large markets such as India’s as the Trump administration gets tough on China’s unfair, predatory trade practices,” says Mohan Malik, a professor at the Asia-Pacific Center for Security Studies in Honolulu, Hawaii.

“Indian officials see China pursuing a ‘beggar thy neighbor’ policy and undermining India’s manufacturing sector by dumping cheap, subsidized goods in the Indian market while importing raw materials from India,” he says. India has filed the largest number of anti-dumping cases in the World Trade Organization (WTO) against China, he notes.

India’s trade deficit with China stood at $51.08 billion in the 2016-2017 fiscal year after a slight decline over the previous 12 months, Indian news website The Economic Times says. That figure was based on total trade of $71.48 billion in 2016-2017. Electronics, machines and chemicals lead Chinese exports to India, while India sends China mainly cotton, copper and precious metals.

Sino-Indian trade had already reached $65 billion by 2013, more than 10 times the figure of a decade earlier.

China has failed in its promises to ease market access to India’s farm produce, IT goods and pharmaceutical products, Malik says. Chinese exports to India reached 2.8% of total Chinese exports in 2016, while China received 17% of India’s total exports in the same period.

“A closer trade relationship with India means more opportunities in the future, as India is expected to be the fastest-growing economy for the next decade,” Yang says. India’s GDP, the world’s fourth-largest, is growing at around 6.5% — close to China’s own rate of acceleration.

However, China has cause to fear India’s economic expansion as Indian wages are generally lower than Chinese equivalents, keeping manufacturing costs down, says Stuart Orr, professor of strategic management at Deakin University in Australia. India would also not be burdened by U.S. tariffs aimed at China.

“If India increases its imports from the U.S., the doors will be open for India to export more to the U.S. as well,” Orr says. “As China’s wage rates continue to rise, China has every basis for fearing an India with a developed manufacturing capability, fueled by the demand […] of more exports to the U.S.,” he says.